Does Insurance Cover Surrogacy? Here’s What You Need to Know

Surrogacy is a life-changing journey, but one of the biggest concerns for intended parents is whether insurance covers surrogacy costs. The short answer is: most standard health insurance plans do not cover surrogacy expenses for intended parents, though some may cover pregnancy-related medical costs for the surrogate. Coverage varies by country, state, and insurance provider. In the U.S., some states mandate surrogacy-friendly policies, while others exclude it entirely. To avoid unexpected expenses, intended parents should carefully review insurance policies, explore specialized surrogacy insurance, and consult an expert to ensure financial protection.

Insurance plans for surrogacy differ a lot between companies like Blue Cross, Aetna, and Cigna. Some plans might cover part of the costs, but most see surrogacy as an elective. This can be a big financial problem for families wanting to go this route.

Finding out if insurance covers surrogacy needs careful research and planning. Knowing about surrogacy coverage can help you deal with costs that can be as high as $50,000. This is especially true for parents without good insurance.

Get in touch for a Free Surrogacy Consultancy:

📲 91-8800481100 ( WhatsApp, Line, Viber)

📮www.georgiasurrogacyagency.com

Key Takeaways

- 50% of health insurance policies do not cover surrogacy expenses

- Out-of-pocket surrogacy costs can range from $30,000 to $50,000

- Insurance coverage varies significantly between providers. Most insurers consider surrogacy an elective medical procedure

- Surrogate compensation packages often cover medical expenses

- Specialized insurance riders might offer limited surrogacy coverage

- State laws can impact surrogacy insurance requirements

Additional guide for intended parents:

How Much Does Surrogacy Cost in Argentina

Understanding Surrogacy Insurance

Surrogacy-related costs generally fall into two categories:

- Medical expenses for the surrogate’s pregnancy – This includes prenatal care, delivery, and postpartum recovery.

- Additional costs for intended parents – This includes surrogacy agency fees, legal fees, and compensation for the surrogate.

While intended parents’ own health insurance does not cover surrogacy-related expenses, the surrogate’s insurance may cover medical aspects of the pregnancy. However, some insurance plans explicitly exclude surrogacy, making it essential to review the policy before proceeding.

Does the Surrogate’s Health Insurance Cover Surrogacy?

Some health insurance plans may cover pregnancy-related medical expenses for the surrogate, but many include a “surrogacy exclusion clause.” This clause states that the insurer will not pay for medical expenses related to a surrogate pregnancy. Intended parents must carefully review the surrogate’s policy or work with an insurance expert to verify coverage. If exclusions exist, alternative options include:

- Purchasing a new individual health insurance plan for the surrogate.

- Using a specialized surrogacy insurance policy to cover pregnancy-related costs.

Does the Intended Parents’ Insurance Cover Surrogacy?

Most insurance plans for intended parents do not cover surrogacy-related expenses. However, there are cases where coverage may apply:

- If the intended mother uses her own insurance for fertility treatments like IVF.

- If the child is added to the intended parents’ policy immediately after birth.

To avoid gaps in coverage, intended parents should confirm with their insurance provider whether the newborn is covered from birth and whether any additional riders are needed.

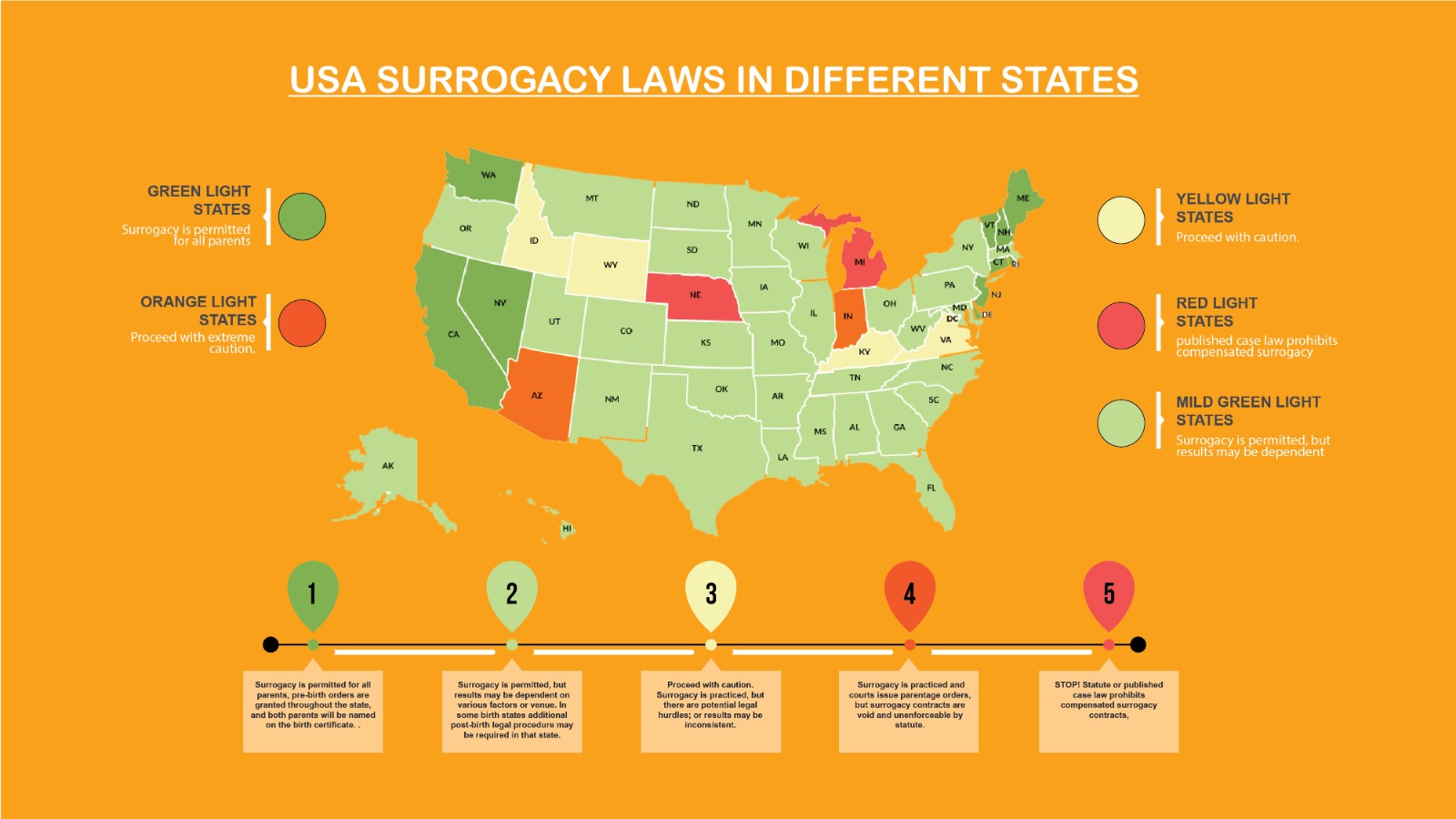

Surrogacy Insurance in the U.S.: State-by-State Differences

Insurance laws vary across the U.S., with some states having more surrogacy-friendly regulations than others.

| State | Surrogacy Insurance Status |

| California | More surrogacy-friendly, better insurance options available. |

| New York | Recently legalized surrogacy but limited insurance coverage. |

| Texas | Coverage depends on individual policies; many have exclusions. |

| Florida | Some surrogacy-friendly policies exist, but exclusions are common. |

| Illinois | Offers insurance options for surrogacy-related medical costs. |

Checking state-specific regulations and working with an experienced surrogacy consultant can help intended parents navigate insurance options.

Alternatives to Traditional Insurance for Surrogacy

If traditional health insurance does not cover surrogacy, intended parents have other options:

- Surrogacy-Specific Insurance Plans – Specialized insurers offer coverage tailored for surrogate pregnancies.

- Medical Cost Sharing Programs – Some programs allow families to pool resources to cover surrogacy-related medical expenses.

- Employer Benefits – Some companies now offer fertility and surrogacy benefits as part of their employee insurance packages.

- Out-of-Pocket Payment Plans – Some hospitals and clinics provide financing options for intended parents.

How to Find the Best Insurance for Surrogacy

To ensure comprehensive coverage, intended parents should:

- Review both their own and the surrogate’s insurance policies for exclusions.

- Consult a surrogacy insurance expert to explore available options.

- Consider purchasing additional insurance if necessary to avoid unexpected costs.

- Confirm newborn insurance coverage to avoid gaps in medical care post-birth.

How Much Does Surrogacy Insurance Cost

Understanding the cost of surrogacy insurance can be tough for parents-to-be. The cost of third-party reproduction coverage varies a lot. It usually ranges from $7,000 to $30,000 a year. It’s important for families to know the costs of infertility treatment insurance when using assisted reproductive technology.

The cost of surrogacy insurance includes several parts:

- Monthly premiums usually cost between $300 and $900

- Supplemental surrogacy insurance can cost between $3,000 and $10,000

- IVF cycle costs range from $12,000 to $30,000

Parents should be ready for extra costs. Not all insurance covers surrogacy-related medical costs. Many health insurance plans don’t cover surrogacy because they see it as an elective procedure. This can lead to big coverage limits.

| Insurance Type | Average Cost | Coverage Scope |

| Affordable Care Act Plans | $300-$900/month | Limited surrogacy coverage |

| Specialized Surrogacy Insurance | $7,000-$30,000/year | Comprehensive reproductive coverage |

| Supplemental Coverage | $3,000-$10,000 | Additional medical protection |

Here are some ways to manage surrogacy insurance costs:

- Look into grants and fertility financing programs

- Check out home equity lines of credit

- Use crowdfunding platforms

- Compare different insurance providers

Doing your homework and planning ahead can help parents deal with the complex costs of surrogacy insurance.

Does Insurance Pay for Surrogacy?

Understanding surrogacy insurance can be tricky. It varies a lot between different companies and places. It’s key for parents and surrogates to know this before starting their journey.

Insurance Provider Policies

Insurance companies handle surrogacy differently. Here are some important points:

-

- Only 20% of insurance providers cover some surrogacy costs

- Blue Cross Blue Shield usually covers more of the costs

- Aetna and Cigna might cover some of the maternity costs

- TRICARE doesn’t cover surrogate pregnancy costs

Coverage Limitations and Exclusions

Surrogacy insurance policies have rules to follow:

- Most insurers need you to try artificial insemination first

- Monthly costs are between $300 and $900

- Annual costs can be up to $30,000

- Supplemental plans have $15,000 deductibles

State-Specific Insurance Laws

Surrogacy insurance laws differ by state. Here’s what we know:

- 20 states have laws about fertility insurance

- 14 states cover IVF

- 12 states have laws about preserving fertility

Parents should talk to insurance experts. They can help understand these laws and find the right coverage for their journey.

Gestational Carrier Insurance Options

Health insurance for surrogacy can be hard to understand. About 90% of surrogate insurance policies don’t cover pregnancies. This makes finding the right coverage very important for gestational carriers.

Gestational carriers face special insurance challenges. Only 1 in 10 potential surrogates have insurance that covers all maternity care. Intended parents usually have to find the right insurance for them.

-

- Verify existing personal insurance coverage

- Consult specialized insurance brokers

- Explore Affordable Care Act marketplace options

- Consider dedicated surrogacy insurance policies

When looking at the costs for gestational carriers, several key points come up:

| Insurance Type | Monthly Premium | Coverage Scope |

| ACA Marketplace Plan | $500-$700 | Basic medical coverage |

| Private Insurance | $1,000-$1,500 | Extended medical protection |

| Specialized Surrogacy Insurance | $15,000-$24,000 | Comprehensive surrogacy journey coverage |

Important note: Military families should know that TRICARE doesn’t cover surrogate pregnancies. They need to find other insurance options.

Working with a skilled insurance broker can help find the best coverage. They can deal with the complex world of health insurance for surrogacy. They can find policies that protect both the gestational carrier and the intended parents.

Insurance Coverage for Intended Parents and Newborns

Finding insurance for intended parents and their newborns is key in the surrogacy journey. It’s important to understand third-party reproduction insurance benefits. This requires careful planning and talking to insurance providers.

Parent Insurance Requirements

Intended parents need to get insurance ready before their baby comes. IVF surrogacy insurance has several important points to consider:

- Review existing health insurance policies

- Understand coverage limitations

- Prepare for potential out-of-pocket expenses

Most health insurance plans don’t cover surrogacy costs. Intended parents should get ready for extra costs related to insurance for surrogacy.

Newborn Coverage Options

Getting insurance for a newborn needs careful planning. The big change happens right after birth. Then, the child moves from the surrogate’s insurance to the intended parents’.

| Coverage Stage | Insurance Details |

| During Pregnancy | Fetus covered under surrogate’s medical policy |

| Post-Birth | Child becomes dependent of intended parents |

Policy Transfer Procedures

Smooth policy transfer needs careful paperwork and quick communication. Proactive steps are essential to ensure continuous medical coverage for the newborn.

- Obtain legal parentage documentation

- Contact insurance provider immediately after birth

- Submit necessary paperwork for newborn enrollment

- Verify effective date of coverage

Intended parents should plan for insurance challenges. Monthly costs can be $400 to $500 under the Affordable Care Act.

Affordable international surrogacy countries

Looking into international surrogacy can make it cheaper for parents-to-be. Countries vary in legal rules, medical skills, and costs for insurance. This includes insurance for the gestational carrier.

Choosing international surrogacy means looking at more than just money. Legal safety, medical quality, and insurance are key. These factors help pick the best place.

| Country | Surrogacy Costs | Key Advantages |

| Ukraine | $35,000 – $55,000 | Strong legal framework, affordable medical services |

| Georgia | $32,000 – $60,000 | Comprehensive surrogacy insurance options |

| Mexico | $60,000 – $82,000 | Proximity to US, growing surrogacy infrastructure |

| Colombia | $60,000 – $66,000 | Emerging surrogacy market with supportive regulations |

SURROGACY IN GEORGIA

Georgia is a top choice for international surrogacy. Prices start at $32,000, with packages from $55,000 to $60,000. It offers good insurance for the gestational carrier and medical support.

SURROGACY IN UKRAINE

Ukraine has a solid legal setup for surrogacy. Costs start at $35,000, with prices going up for extra tests. It has good insurance options for parents.

SURROGACY IN MEXICO

Mexico is a good option for those in North America. Prices are $60,000 to $82,000. It’s close and has growing surrogacy services.

SURROGACY IN COLOMBIA

Colombia is a new player in surrogacy. Prices are $60,000 to $66,000. It’s getting better at insurance and medical support for parents.

Important Note: Always talk to legal and medical experts before going for international surrogacy. They can help with the rules, challenges, and insurance.

Additional guide for intended parents:

How Much Does Surrogacy Cost in India

How Much Does Surrogacy Cost In Kazakhstan

Conclusion

It’s important for intended parents and surrogates to understand surrogacy costs covered by insurance. About 60% of health insurance plans don’t cover surrogacy costs. Families need to find ways to cover these expenses.

While most traditional health insurance plans do not cover surrogacy expenses, intended parents can explore alternative solutions, such as surrogacy-specific insurance, employer benefits, or private policies. Consulting an insurance expert and understanding state-specific regulations can help navigate this complex process and ensure financial protection.

By being proactive and well-informed, intended parents can minimize financial risks and focus on the incredible journey of growing their family through surrogacy.

We are happy to assist you with one of our global surrogacy programs best suited you your personal, financial,, and legal needs. I am here to assist you every step of the way.

Get in touch for a Free Surrogacy Consultancy:

📲 91-8800481100 ( WhatsApp, Line, Viber)

📮www.georgiasurrogacyagency.com

FAQs for Does insurance typically cover surrogacy

Does insurance typically cover surrogacy?

Insurance for surrogacy varies a lot. Most health insurance doesn’t cover all surrogacy costs. Intended parents might need to buy special insurance or get specific coverage.

Some employers and states offer better fertility and surrogacy insurance. But this isn’t true for everyone.

What types of insurance are needed for a surrogacy journey?

A good surrogacy insurance plan covers the carrier’s medical costs, any complications, and life insurance for the surrogate. It also includes disability coverage. Intended parents should get health insurance for the baby and think about liability protection too.

How much does surrogacy insurance cost?

Surrogacy insurance costs can be from $5,000 to $30,000 a year. This depends on the insurance company, where you live, how much coverage you want, and the policy details. You might also have to pay extra money not covered by insurance.

Are there state-specific differences in surrogacy insurance coverage?

Yes, surrogacy insurance varies by state. Some states require fertility treatment coverage, while others don’t. States like Massachusetts, Illinois, and New York have better laws for fertility and surrogacy insurance.

What insurance options are available for gestational carriers?

Gestational carriers can look at their current health insurance, special surrogacy insurance, or the Affordable Care Act marketplace. Intended parents usually have to pay for extra insurance and make sure the surrogate is fully covered.

How do intended parents secure insurance for their newborn?

Intended parents should plan by adding the baby to their health insurance or getting a new policy right after birth. They need to talk to their insurance company and provide the necessary documents from the surrogacy arrangement.

What are the challenges of international surrogacy insurance?

International surrogacy has its own insurance challenges. These include different medical standards, limited coverage, and legal issues. Countries like Georgia, Ukraine, Mexico, and Colombia have their own insurance rules. You’ll need to do a lot of research and might need extra private medical coverage.

Are there any insurance options specifically designed for surrogacy?

Yes, some insurance providers offer policies just for surrogacy. These cover medical costs, complications, and other related expenses. These policies are more detailed than regular health insurance and can be customized for surrogacy needs.

Source Links

- https://resolve.org/learn/financial-resources-for-family-building/insurance-coverage/insurance-coverage-by-state/ – Insurance Coverage by State | RESOLVE: The National Infertility Association

- https://www.nivabupa.com/health-insurance-articles/surrogacy-medical-insurance-finding-the-right-coverage.html – Surrogacy Medical Insurance: Finding the Right Coverage

- https://www.ivfconceptions.com/can-my-insurance-provider-pay-my-surrogacy-costs/ – Can My Insurance Provider Pay My Surrogacy Costs

Highly esteemed, authoritative, and trusted professional with a 14-year of experience in international surrogacy. Advocate for Secure, Legal, and Affordable International Surrogacy.

Neelam Chhagani, MA (Counselling Psychology) and Holistic Infertility and Third-Party Reproduction Consultant.

Member of European Fertility Society, Best Surrogacy Blogger of 2020, with 300 dedicated blogs, and top contributor on Quora for Surrogacy.

Add Your Comment